Best Personal Capital Alternatives: There are lots of tools that are related to finance and also some of the other apps are available in the market which helps the users with their money. Also, there are lots of other options due to which people get confused about which one is best and in this term, people are looking for the best one to use.

Best Personal Capital Alternatives in 2021

It may be that you will get to know about the personal capital and also some of the other apps like personal capital which will be really useful for the users to keep and handle all their financials by sitting at one place and also, they help you to track your net worth and also they can easily be able to monitor your investments and spendings as well.

If you are reading this article then it may be possible that you are using personal capital and also it may be that you are looking for its alternatives. I also love to use personal capital but there are several reasons due to which I need to switch from that platform.

We know that you don’t like some of the features of personal capital like it doesn’t suit you and that’s why you want to look for more platforms to check other services.

Whatever the reason is but below we are sharing some of the best alternatives to Personal Capital. So, if you want to know about it then simply read the below-given article completely in a proper manner.

What is Personal Capital?

It may be possible that you know about personal capital and also use it as well and have a proper understanding of its available tools. But, if you are looking for the apps like personal capital then here we are going to share some of the free personal capital alternatives which will be helpful for you.

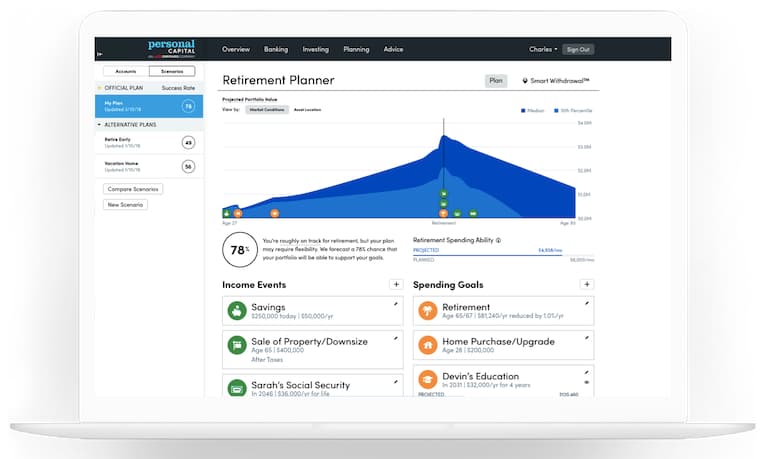

Basically, personal capital is one of the financial platforms where it provides investment planning and also wealth management tools that give banking tips as well. Personal Capital comes up with free and paid versions. In the free version, you will get spending analysis, spending and saving analysis and also the portfolio performance and retirement progress, and also complete net worth as well.

In their retirement tool, you can easily be able to plan for your retirement and also be able to do proper experiments related to your saving strategies as well.

If we talk about its paid version, the Personal Capital is for the users who want to invest a minimum of $100,000. Also, its upgrade provides an advisors team who help you to manage your wealth and also they take only 0.89% fee.

Apart from this, if you want to invest more than $200,000 then you will get two financial advisors and also you will get a customer ETF portfolio as well. If you invest more than $1 million then you will get a fee of less than 0.49% and also you will be able to invest in the single bonds as well.

Who is Personal Capital Good For?

Basically, personal capital is one of the best tools which helps the people who want to link all their bank accounts and also who plan their retirement by using one dashboard only. It is one of the best choices only if you want to get to know about your net worth, investments, and want to track your received insights, and want to know about how to manage them in the best way.

If you only want to use the free version then you will be able to get an investment check-up and also you will get a 401k fee analyzer as well. Also, the personal capital tool helps the users to analyze their assets, and also it will let you know that you need to rebalance your investment or not.

The personal capital dashboard also allows the users to check all their investments in one place by which users can be able to make decisions properly. It is one of the best tools for DIY investors.

Personal Capital is also one of the best tools for those people who are seeking investment help and also who want to make $100,000 and more investment. If you want to do so then you will also get a financial advisor who is completely dedicated to you and advises and guide you in a proper manner.

You will get the proper answer to all your questions related to finance from these advisors like your retirement planning, taxes and also buying a new house as well. They are very less expensive as compared to the traditional financial advisors who charge a 1% fee.

Also, personal capital is not for you if you are seeking help from wealth management but doesn’t have the $100,000 to begin. If you are one of the small or medium investors then you need to go somewhere else. Personal capital is not the best budgeting tool for those people who want to manage and forecast their expenses.

If you are willing to try the app then you are required to simply sign up and use Personal Capital for free of cost. It is something which you are looking for.

Best Personal Capital Alternatives

As we said at the beginning of this article, here we will tell you about some of the best personal capital alternatives and finally, we are sharing below. These are the best alternatives which you must need to try. All these options are not the same but lots of them are able to provide you with similar features like personal capital and also they help you to improvise your financial health easily.

So, if you want to know more than the net worth and some of the other investment tracking then these tools are really interesting for you.

Mint is one of the best alternatives to personal capital. It is one of the free budgeting apps which helps users to budget their money. Also, it syncs with your bank account, and also it will track all your financial transactions like income and expenses both.

It is one of the first budgeting apps in the market and also it provides lots of features like alerts, cash flow breakdowns and also you will get the budget pie charts as well. Mint also provides a dashboard that helps the users to check their cash balance, debt, and also their complete investment portfolio value as well.

Mint will show you where your money is going and also it will give you an alert if you are not meeting up with your budget or if any of the upcoming bills are due.

You Need A Budget which is shortly known as YNAB is one of the similar “alternatives of personal capital” and also similar to the mint as well. It mainly focuses on the changing of your behavior. YNAB plans something which we can say is zero-based budgeting where every single dollar spending comes under the budget category.

It will allow the users to track down every cent which they spend and foe which they are not aware of. YNAB mainly forecasts your budget and helps you to plan for the future.

It is one of the best tools which helps you to start saving and tacking your budget in a serious manner and it only costs you $11.99 monthly. Also, if you want to get a yearly plan then you need to pay $84 per year. Also, it will provide you a 34days free trial period so that you will get to know about its features and benefits to like it.

Savology is one of the personal capital alternatives which mainly focuses on the analysis of financial life and also it will create a personal plan along with the actionable steps which help the users to achieve their goals.

Also, savology provides a budget and plan to help the users to keep track of their retirement, insurance payments, and more.

This platform will help the users to access their strengths and weaknesses as well and it will encourage them to review their financial performance indicators as well.

Savology also provides its own report card where it will grade all the categories so that you can easily get to know where you need to improve. It is completely free to use and while using it, you will get your financial plan within 5 minutes.

Simplifi by Quicken is one of the apps which will gather all your financial information and also it will aggregate it in one tool only. Also, it will allow the users to check out their bills, and also users are able to create their plans of spending and are able to set their financial goals as well. Apart from that, it will sync all your financial accounts and it helps the users to get to know about their patterns in terms of their spending and their income.

Simplifi also helps the users to track their spending where they can easily be able to create a budget that helps them to monitor their financial health.

It also provides a “Simplifi Dashboard” to the users where all the Simplifi users are able to get to know about their performance by getting a visual representation of their next month’s balance. For this platform, users are required to pay $3.99 monthly or $39.99 yearly but for your self-satisfaction, they will provide you 30 days free trial.

Now one of the personal capital alternatives is EveryDollar. It is one of the tools which was associated with Dave Ramsey where it helps all its users to manage their budget and also their income as well. This app is based upon the budgeting rule and it allows the users to track every single dollar which they are spending.

If you use its paid version then, it will sync all your transactions that take place by your bank account, and also if you use this app, then you will get complete customer support on the phone.

EveryDollar doesn’t track your investment but it helps you with the planning of your retirement. Also, it will help you to know more and more about the budgeting system.

EveryDollar provides a free version where you can access some of its features free of cost and also, if you use its paid version which costs you $129 yearly then you can be able to access all its features easily.

You don’t need to worry as you will get a 14 days free trial if you want to check its paid version.

Now here we come with the best personal capital alternative which is known as Pocketguard which will be able to sync all your financial accounts on a single dashboard. Also, with this, you can be able to link everything like your credit card, retirement accounts, loans, and also it will provide you your own personalized recommendations.

As per the data collected by this app, it will easily create a budget and then it will be able to help the users to set their goals. Also, they have their personal “In my pocket” feature by which users are able to get to know about the available balance after complete payment.

Pocketguard is also able to analyze all your bills and also it will help you to get to know all the available alternatives which are cheap. It is having a free version and also a paid version as well which is available at $3.99 per month to $34.99 per month.

Tiller Money is one of the apps where users can be able to get back to the basics and then they can easily be able to begin from the spreadsheets. Also, it will enter all your budget into several spreadsheets which were built after syncing your transaction data with the help of all your bank accounts.

Also, with this, you can easily be able to customize your spreadsheet, and also you can easily save all your data offline into the Excel Sheet. Also, apart from this, you can easily be able to try the platform free of cost for 30 days and after that, you are required to pay $79 yearly.

Have you ever used the physical envelope when you first used budgeting with cash? If yes then we will tell you that the Mvelopes works similarly to the budgeting strategy and also it uses digital envelopes instead of physical envelopes. Also, Mvelopes sync all your bank accounts and also it will help the users to budget as per their data.

Also, their official app mainly focuses on the people who struggle to be on the budget or on debt as they said on their website. Their main aim is to help the people to recover at least 10% of their income regularly.

Mvelopes provides a 60-day free trial and they have three paid tiers that are completely different from each other and also they have lots of features as well. Their basic tier begins at $6 monthly and also if you adopt the premium version then you have to pay $19.99 monthly.

Now here we come up with another mint personal capital alternative which is known as Pocketsmith. It is one of the best budgeting tools and it uses the calendar by which it will track all your spending and provides complete details about how much you can spend on a daily basis.

This type of budgeting is one of the best approaches for those people who like to see the visuals of the budget.

Pocketsmith also gets sync with your bank account and provides the multi-currency bidgetting, cash flow forecasting for Fire interest, net worth monitoring, and also budget forecasting as well.

It is also having a free version but apart from that it also provides the paid version which starts from $9.95 per month to $19.95 per month.

Banktivity is one of the money management software which is only available for iOS devices because it only works on Apple devices and it was owned by the IGG software. Banktivity will sync your apple device and it will provide several features like budgeting, tracking investments, and also the paying bills service as well.

Also, it will provide some of the other tools where it allows the users to pay the bills of their particular bank accounts, and also, with the help of this, you can easily be able manage your money as you want.

It also gives great reporting tools by which all the users can easily be able to customize their personal liking. Apart from that, the latest version of Banktivity takes a one-time fee which only costs you $69.99.

Now the last alternative to personal capital is Albert. It is one of the apps which sync all your bank accounts and also it will guide you in investments and is completely able to track your net worth. Also, it will monitor all your bank balances and create your investment portfolio properly.

Also, they provide a feature which is known as Albert Genius where you will get the proper financial advice.

Albert is also having a unique savings system where it will monitor all your weekly spending and also, with this, you may be able to withdraw a small amount on a weekly basis.

Final Verdict:

If you have a personal capital or if you switch to any one of the personal capital alternatives which we shared above then let us know by dropping a comment below.

Also, tell us that which is your favorite personal capital alternative. Simply drop your comment below and let us know and also, if you still have any query then don’t hesitate to let us know in the below-given comment section.